FTSE 100 CEOs Leaving in 2021 – What Does It Actually Mean To The Public Though?

Reading Time: 10 minutes

Examples

From Left to Right: Shay Segev, Craig Hayman, Marco Gobbetti

1. Entain (Gambling) – Shay Segev, 45 – left in January 2021 to become co-CEO of British unicorn DAZN Group Limited, a British sports media company (OTT subscription than pay-per-view) owned by Access Industries / owned by billionaire Sir Leonard Blavatnik for better pay.

Shay has experience in the technology sector and was the previous COO of Playtech (FTSE 250). He has a BSc in Computer Science from Tel Aviv University and an MBa from Northwestern Kellogg School of Management. Shay handed in his notice in the middle of an £8 billion takeover fight with MGM resorts, of which the all-shares offer was allegedly rejected for undervaluing the company and its prospects. The US is known to have deregulated its gambling sector and on the backing of this have been seeing to expand and thus capitalise on British firms’ digital expertise and products. However, he claims this was not influencing his decision to leave elsewhere. Interestingly, he only became CEO in July 2020 and within his service contract must serve a 6 month notice period. Allegedly, him and the Chairman stated Entain had, at the time, strong internal management below him on the bench in order to continue supporting the strength of the company’s future. Entain were looking for a third CEO in less than 6 months of which Jette Nygaard-Andersen, one of the only female CEOs in the FTSE 100, was snatched up in January 2021 in order to fulfil this role.

2. AVEVA (Software) – Craig Hayman then left the company in April 2021, reportedly due to personal matters. Allegedly, AVEVA reported a flat organic revenue for the financial year, which ended in March 2021, due to pandemic-related disruptions which reporters suggest might be another reason for his departure. The company shares fell 5%, and Herweck, Schneider’s executive of AVEVA’s biggest shareholder, was lined to to take over due to his previous experiences at Mitsubishi and Siemens, two other major technology-and-manufacturing related companies. It was a surprising moment for a CEO to quit after a monster acquisition and begs the question: has something gone wrong with the deal? Who is going to integrate it and take final responsibility for it now?

Hayman has a Bachelor’s degree from the University of London. Previously, he has worked as COO of Ptc Inc before becoming CEO in 2018. AVEVA itself, helps companies digitise factory lines and supply chains, measuring the performance of every valve and pipe in machinery and flag when replacements or tweaks are needed to improve efficiency. In order to expand AVEVA's expertise and portfolio, Hayman was part of a team to recently acquire Softbank-backed OSIsoft in a reasonably aggressive tender from other bidders for the cost of $5bn, partly financed with proceeds of a £2.84bn rights issue. The justification for making this acquisition is that OSIsoft’s systems will create real-time information and establish a data historian portal in order for improved industrial data and thus systems efficiency, particularly with AI technology to entice AVEVA’s current and future clients. The Schneider Electric Company's (AVEVA’s biggest shareholder) Chairman has taken an interim position in the top spot until an appropriate candidate has been sourced. However, there are tensions about the direction of the company as Schneider being French-incorporated could see the company run under French influences as opposed to how UK businesses are conducted and regulated with British investors.

3. Burberry (Fashion / Luxury Retail) – In the middle of the summer, sending shockwaves through the fashion industry, Marco Gobbetti similar to Segev, announced his future departure in order to become CEO of Ferragamo, who are an Italian luxury footwear company. With the company being left in the lurch due to slow recovery of the company, slowed down considerably due to COVID-19 (understandably as luxury items have not been deemed a priority by consumers) leaves the company in the potential position for a possible takeover. On announcement of the news, the share price immediately collapsed by 8% demonstrating how important and significant having a reputable leader in the top seat is for a company to succeed. A mini media frenzy circled possibly because the announcement was so sudden and unexpected, and especially because Gobetti brought along esteemed colleagues of his from Cara Delevigne and Riccardo Tisci, to now also leaving them behind.

Marco’s background is that he has a career in management at luxury companies such as Bottga Veneta, Valextra and Moschino. He has also obtained a Business Administration degree from the American University and MA in International Management from Thunderbird School of Global Management. Previously taking the CEO role at Burberry, he also was CEO of Givenchy and Celine (owned by LVMH) of which his long-term allyship with Riccardo Tisci was how he brought him along to Burberry later on. Reports have been circulating that Gobetti is moving from one restructuring job to another, which if that’s where his strengths as a leader lies, and he will be returning to his home country to support such a project, it is understandable he is doing what he is comfortable in doing and where he will be doing it. According to Reuters, under Gobbetti’s leadership, Burberry shareholders enjoyed a total return of 47% which is significantly lower than competitors such as Kering (owens Gucci and YSL), LVMH and Moncler who enjoyed 200% in comparison so as stated before it does leave Burberry in a vulnerable position, which can lead to a potential takeover.

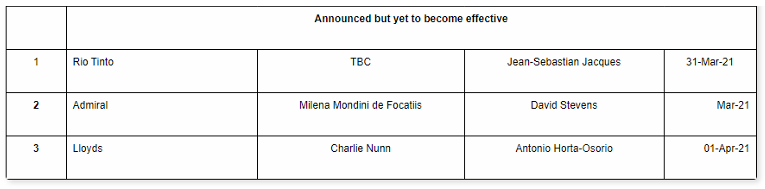

Other examples of FTSE 100 CEO transitions during 2021

What happens because of it? What happens as a result of it? Why might it happen?

As you can see in two out of the three situations above, a CEO has found a better opportunity elsewhere. However, there are a multitude of other reasons for why a CEO chooses to leave. There is the rare occurrence of them becoming incapacitated or the event of death. Other than that, another common reason is that sometimes the board has decided a change is needed in relation to the company’s present performance conditions, whether the company’s performance has been poor or the Board see a change in direction is required for its new future vision. This is an issue which the Nominations Committee, and proxy advisories, must assess to see if a company is being looked after the best interest of its shareholders, and can be due to the Company’s direction being identical to the personal beliefs of its leader. The result in the Board vs CEO dilemma might have been brought about due to the breakdown of trusted confidence between board members proving impossible to come to a resolution (usually between the Chairman and the CEO in the case of Steve Jobs and Apple back in the 80s and 90s). In extreme situations, a CEO may choose to resign if they disagree with the strategic direction the company should take which the remaining Board members are willing to take. Or the company is no longer willing to provide D&O liability insurance for its directors, which is usually due to the company being in a dire financial situation or is suffering from brinks of corporate bankruptcy (which is why leaders would like to leave early in order to not face scrutiny and repercussions that they will endure during this tumultuous period otherwise).

In rare occasions where shareholders revolt over certain policy proposals or payouts, to save face and maintain satisfaction from its shareholders, some leaders get the boot and this has implications on the future, unexercised payout the CEO was expected to obtain. If a CEO has left for benign reasons, one is to assume that they will make a tidy exit including giving the rest of the board plenty of notice and then in the meantime of the notice period (sometimes lengthy) it provides a chance for internal talent teams and external executive search agencies to find a suitable replacement. The standard process usually involves providing a letter of resignation to signify a contract of separation, pursuant to the rules of the service contract issued by the company.

Regardless of how the situation has come about, all Boards must anticipate succession planning in order to mitigate the risk of a Company without a long-term leader. The Nominations Committee and Executive Search agencies are constantly pooling potential candidates year-end through strategic introduction sessions (of which these meetings must have all participants sign an NDA to mitigate any worry for internal terms or external public outcry).

An example of how the Remuneration packages are reported in the Remuneration Report section of a company’s Annual Report, with special mention to Shay Segev (above) outlining his payable vs. non-payable elements.

LEAVER PROVISIONS

So how do companies have to report this notice of leave? Nomination and Remuneration Report

The S430(2b) Notice, Shareholding Arrangements and Buy Out Arrangements

There are two main disclosures which have to be made which report the notice of leave and their remuneration arrangements of a UK-incorporated company CEO: that is a s430(2b) disclosure with reference to Companies Act 2006, and making a statement within the Director’s Remuneration Report and Nominations Report in an upcoming Annual Report. The s430(2b) statement is provided on a Company’s Investor Relations page to make a one-off statement as opposed to disclosing the director’s emoluments in detail in future annual reports. It will disclose the name of the person concerned, a clear description of payments to be made to [at the time past] executive directors and the method of calculation of payments, and if there are any payments to be made for the loss of office. It is vital to report the pro-rata balance of fees which will be received by said individual due up to cessation of directorship. Furthermore, any outstanding shares will usually be pro-rated which are under the company’s long term Incentive plans and any other variable compensation plan said individual is a participant of. The Remuneration Committee has the responsibility to judge whether they should exercise discretion under the plan(s) and whether to treat the CEO as a “good leaver” for any unvested options under the CEO’s cessation (these can generally either vest on cessation or lapse immediately).

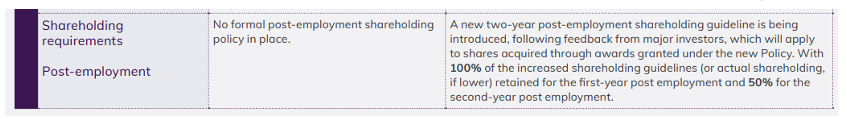

When it comes to disclosing the remuneration of an incoming CEO, usually the Remuneration Committee can apply discretion in adding the value of lost shares from the CEO’s ex-company into the new remuneration package so as the CEO is not coming into a loss (which has many complexities in itself such as variable share prices and share class types). Executive Directors are instructed to build up significant shareholdings in their company’s shares, as a % of their salary, in order to apply confidence to external investors and shareholders that they too value the company's strategy and hope for successful long-term performance. The IA considers that post-employment shareholdings, typically held in an employee ownership trust, should apply at least two years at a level equal to or lower than the in-post shareholding requirement - the market however, has seen disclosures whereby the second year can have a further reduced shareholding or reduced deferral period. These can vary depending on the best practice recommendations of certain regulatory commissioners or investment management guidelines, such as from Legal & General or BlackRock.

The alternative to an s430(2b) as mentioned above is to disclose said fees in the Director’s Remuneration Report - a more detailed disclosure pertaining to some disclosure and corporate governance provisions, which has to be reported on an annual basis until the officer has no more compensation ties to the company.

Taken from AVEVA Group PLC’s 2021 Annual Report notifying readers of the shareholding and post-employment shareholding requirements.

Other Leaver Provisions: Service Agreements and Succession Planning Reports in Nomination and Remuneration Reports

Typically UK CEOs, and other important Executive Directors, must give notice which can vary in length but it typically is between 6 to 12 months (and usually no longer than this 12 month period unless in exceptional circumstances). The Nominations Committee will determine an appropriate notice period taking into account circumstances of the individual and typical market practice and all of these details are reported in the Annual Report and the Executive’s individual service agreements.

Other parts of the compensation package such as the LTIP or deferred bonus arrangements may normally lapse too, depending on the rules of the service arrangements and rules disclosured in the Remuneration Report. Some of the shares or options may have already vested, and dependent on malus & clawback provisions can typically remain in a paid out state. Regarding outstanding unexercised options, any that are held by participants who leave employment other than due to gross misconduct may still be exercised for a period following cessation of employment dependent on relevant performance criteria over a certain period to date (subject to Remuneration Committee discretion). Furthermore any shares or options a participant has been provided need to be carefully considered to take into consideration dilution and individual participation limits. Other parts of the employment contract which are agreed upon when parting ways are dealing with explicit covenants in order to protect confidential company information (such as ingredients, products, solutions etc.) and in extreme cases to put limits on directors being able to enter direct competitors, and/or liaise with specific customers and employees for a significant period of time.

What impact does a CEO leaving have on the company’s share price and what does this mean for shareholders?

During this period there is more scrutiny placed on the Nominations committee due to the credibility of their decision making in successors. Yet reports do widely indicate that there is no correlation between how share performance performs on the day a new CEO is finally announced and how the share price performs going forward. However, it is believed that share prices can be more volatile if the outgoing CEO creates a sudden announcement (tying into Burberry CEO’s departure) and the language surrounding the CEO’s departure leaves room for interpretation to the investors that they may have not left voluntarily/other internal reasons.

So how does succession planning take place and what faith do investors and proxies have that the nominations committee will make the right decision?

Nomination Committee members should always anticipate CEO change. In brief, while many boards have an emergency plan, such as having an interim candidate, boards will need to keep revising their crisis management plan and liaising with general counsel at a law or accounting firm. This is usually to add a level of corporate governance compliance in them having independence oversight but also the aforementioned firms are more specialised in corporate governance, employment law and SEC and disclosure reporting and will know best practice regarding succession planning in these areas.

Typically nomination committee members are looking for a variety of skills, knowledge and market industry experience. The board members will draft a letter setting a description out to typical candidates outlining the role responsibilities and expectations, and what support they will provide (and be provided) to the Board regarding this succession planning period. The Board also needs to communicate their decisions to investors as to why they believe this individual should be appointed and how they meet the role requirements.

Taken from Burberry’s 2021 Annual Report’s Nomination Report. It lists out the different backgrounds, skills and requirements the Board requires in order to have a fair representation of diverse backgrounds but also the relevant experience needed to support the company.

If you would like to read more, please find the below sources and some wider literature texts:

[D] Retired or Fired: How Can Investors Tell If the CEO Left Voluntarily? (harvard.edu)

[E] How Companies Can Prepare for Sudden CEO Turnover (mit.edu)

[F] All change: an unusual period for FTSE 100 CEOs | Shares Magazine

[G] Entain-2020-Annual-Report.pdf (entaingroup.com)

[H] LSE_AVV_2020.pdf (annualreports.com)

[I] Burberry Annual Report 2020/21 (burberryplc.com)

[J] Principles-of-Remuneration-Nov-2018-FINAL.pdf (ivis.co.uk)

[K] FTSE 100 bosses still outlast football managers despite management merry-go-round in 2020 | AJ Bell