Example of a Bad Recording Contract: Mariah Carey

READING TIME: 15 minutes

Why Write About This Now?

Initially Glitter was a stain on Mariah Carey’s 90s track record. It peaked at No. 7 on the Billboard 200 back in 2001. However, time, the ultimate truth teller brought the album to Number 1 on ITunes in 2018 after the #JusticeforGlitter campaign. More recently, after fan demands, Glitter was only just uploaded on Spotify and other streaming platforms, which speculates that there were tensions with EMI/Virgin and Carey negotiating a licensing deal. Normally songwriters have a statutory authority to end the transfer of ownership of their product after a period of 35 to 40 years but since Glitter has only reached this halfway point to date it can be assumed early negotiations took place for the immense general public (and lambily) demands to have streaming access to the soundtrack. Due to Glitter’s original infamous release being around a time in a world where a political and financial crisis was taking place, it being uploaded now during COVID-19 which is another political and financial global crisis seems like weird but convenient timing to make “reflections”. This two part discussion will assess why Glitter faltered. Part 1 will discuss from a finance and business perspective. Part 2 will discuss from an artistic perspective.

FROM A BUSINESS PERSPECTIVE…

The recording industry fickle is no secret. Popstars fade in and out with a shelf life from a few months to a few years at most - and the ageist, misogynistic, homophobic and racist undertones within the industry display how the extremely shrewd power figures can be when they handle their products. Except in this business model it’s not something intangible or a non-life form product that’s selling...it’s humans and their art.

In 1988 a talented and undiscovered back up singer to Brenda K Starr, Mariah Carey, was experiencing her first bidding war when her demo tape was passed around top music executives from Sony to Warner after being introduced to them at an after party. In the end she signed to the former's label Columbia Records with the promise that she owned the songwriting credits and masters to her creations in exchange for a 6 studio album deal (and more seeing as she over delivered during her tenancy). By the end of the 1990s decade, with relentless promotion and marketing and a moderately squeaky clean public image, she became one of Sony’s most profitable and valuable assets within its roster selling approximately 100-120 million records at the time. However, just like any company, this recording artist throughout her contract was merely seen as just another pawn to the company and the "caged bird" would incessantly write, record and render to the company's requests. With personal and business difficulties soaring at the end of the decade, Mariah was seeking enjoyment to becoming a free agent and creating a contract with a new label to fulfil her new passion for film alongside music: Glitter.

EMI required high profile stars on its roster because labels knew in order to manage the company’s failures or losses, they depended on a small percentage of artists and their recordings which would be highly profitable, to make up the difference. The purchasing power and valuation of music labels skyrocketed in the 1990s after a series of absorptions and acquisitions led to the formation of label giants Sony, BMG, Vivendi’s Universal and Warner; EMI were also emerging as a top player and showcased this by acquiring Virgin Records in 1992. In 1999-2000, Warner had Madonna, Brandy and Faith Hill; Sony-BMG had Celine Dion, Britney Spears, Destiny’s Child, the Backstreet Boys and NSYNC; Universal had Eminem, Garth Brooks, Limp Bizkit and Shania Twain. EMI had Janet Jackson, the Spice Girls, Lenny Kravitz and Blur but they needed another huge star who they could risk on taking as being their main competitive product. Carey’s liberation at the turn of the millennium came at the right time for EMI’s signing. However, EMI would also be competing in a world full of then ‘prestige signings’ like those from Janet Jackson (which EMI/Virgin had previously carried out in 1996), Michael Jackson and Madonna. A benefit of this practice would showcase the success of a company flaunting off the fact the label had the funds to propose such deals. Nonetheless deals did not always come to fruition as EMI struggled to break Robbie Williams and Kylie Minogue into the North American American market. They were both offered lucrative deals off the back of their European and Oceanic success but the North American market had the most profit-making potential in any worldwide region which neither took off in.

Carey’s candidate profile was exemplified through her mid-to-late 90’s sales figures from Daydream, Butterfly and #1s which with singles sales accumulated nearly 65 million records (approximately worth $500 million) so EMI’s board must have seen that with the right promotion Carey would still be a worthy investment to the company if she could replicate these numbers. Due to her plethora of hits, especially in North America, the board would have presumed that she was still in a position to crank out more hit songs and albums with no slowing down. They were so convinced after Rainbow’s debut were the highest of Carey’s career at the time, they were willing to buy her out of her Sony contract early for $20 million. One could say that the anticipation for a side-by-side soundtrack and movie release through Carey and Glitter would be EMI’s 2000s renaissance of The Bodyguard, which is probably the level the label were expecting to emulate. These targets were not unusual for its time because at the height of 2000, the best selling albums were shifting 20-30 million copies. Also EMI perhaps saw potential that Mariah Carey had greater synergies which would be profitable to EMI in the future: her r&b/hip-hop background was an element missing in EMI. At the time they had not taken full advantage of what was selling in the current climate, where “urban” music (a term which should now be outdated, as deemed by Republic Records, Universal in 2020) was becoming an increasing share of the music genre market in North America and Europe. Therefore if Carey joined the label perhaps a domino effect of other artists from that genre would join too thus generating a increase in EMI’s revenues. So Carey was offered a 5 album-deal with lucrative advance payments totalling to $80 million. EMI’s tactic was probably that this high risk, as is the usual case with expensive contracts, would be associated with higher rewards if successful.

By the time Glitter was released after several delays, the board was disappointed with its sales and how it would impact their forthcoming revenues and profits. Glitter sold 116,000 copies in its first week (almost 1/3 of her preceding album) and 500,000 copies within a few months in the US, and with 2 million copies worldwide. For most musicians this would be hitting targets but this project came to a loss of $7 million to the label. 2001 was no longer a time where the music industry was forgiving for a record not performing greatly on the first go. The stakes were higher since artist contract fees had notably increased. One major exception to this rule was witnessed in Arista with Carey’s contemporary Whitney Houston. Her 1998 LP My Love Is Your Love debuted and peaked at number 13 on the Billboard 200 with 123,000 copies. It eventually shifted almost 4.5 million album sales in the US and 14 million worldwide, but this was the last of Whitney’s contracted albums from her 1985 contract so Arista were probably more forgiving to her. Also Houston would make up the cash through a worldwide tour and a bit more television performances. On the other hand Carey’s exhaustion by late 2001 may have made it unlikely for her to have toured in 2002 to make up her loss; alongside a post-9/11 world, touring would have most likely been put on hold in general due to an increase in associated risks around flying. Janet Jackson showcased this by cancelling her European Leg of her ‘All For You Tour’ for this reason. Overall Glitter left a huge dent in EMI’s pockets. The board realised their overvalued acquisition and the initial investment into Glitter could not make up for its losses; Carey also had high contractually obligated advance payments and the album blew high promotional campaign fees. So a rapid strategy would be to highly promote and offer other alternative successful products to make up for the loss but no other major star in EMI's roster was releasing in late 2001 and very few musicians were willing to tour either.

So EMI then tried to merge with Warner or BMG. However, after several failed attempts EMI realised it needed to survive by standing on its own legs and recover from its financial decisions by changing internal processes. The mergers mainly failed due to European legal issues who were predicting a brew of anti-competitiveness, particularly in Europe, because if the merge took place this would be deemed bad governance within the recording industry having only a few major competitiors. Beforehand EMI’s preliminary results for the 2000-2001 period suggested the company was still in good shape. In May 2001 EMI reported a 12% increase in revenue of $3.79 billion. However, these results plummeted as profit warnings were issued later in 2001, most likely brought about by the 9/11 post-recession period as Universal and Sony had them too. By March 2002, company profits had decreased by 20%, the company share price decreased to its lowest levels since 1988 and EMI decreased its US market share by 5%, only kept head above water by the outstanding success of The Beatles ‘1' compilation album. According to the LA Times, EMI at the time had lost $77.6 million in the first half of the fiscal year. Shareholders were unanimously displeased with the results so to rebuild shareholder confidence the company required a complete overhaul and restructuring.

Alain Levy, a previous successful Polygram executive was brought in and carried out a ruthless cost cutting task so that EMI could have a lower cost base to work with in the future. One of these decisions was to terminate Julie and Ken Berry, the CFO and an Executive at the time, as they were both at fault for complying with Carey's deal. To save costs even more, Levy was put on a remuneration package on a mere 20% of which his peers in competitive companies were receiving. Lastly, it may seem a bit drastic in that EMI were unforgiving for letting an artist go after one project but Levy probably foresaw that they would not get their future investments back from Carey’s subsequent projects. These would require huge promotion campaigns, higher public relations fees to also fix her public image and there may have been strict financial terms in Carey’s contract over her musical rights and control which EMI could not longer oblige with. So Carey’s contract was also terminated with a $28 million severance payment which marked the first time a label cut its losses on an unprofitable star after one album. Alongside this 1800 other jobs were slashed but this would still leave EMI with a hefty redundancy pay package price ticket. After these announcements were made to shareholders the share price again dropped significantly as these payouts were also causing losses to the company.

The major lesson from this case study is to not bite off more than you can chew, especially in a volatile and rapidly-evolving market. Glitter's case highlighted that major stars who were aging were going to be potential financial burdens and their star was beginning to dwindle. So if they were looking to renew or negotiate a new music contract at this time, Carey was the first example of an industry norm where labels would prefer to shove out expensive or loss-making music veterans to make space for the new, fresh faced and more youth focused acts. Younger acts were also willing to have cheaper contracts as they required to prove their worth and they were more likely to engage in 360 deals so their endorsements and other revenue streams would contribute to the label’s financials too. EMI should have also recognised that the 1990s music industry market growth was like living in a bubble and sooner than later this consistent growth was going to pop. Experts were already worried about how they were trying to survive from Napster. Napster was a peer-to-peer platform to share music online illegally and spread like wildfire. The recording industry was petrified that it was tearing an irreparable rip in their business model which was that a large proportion of their consumers would no longer purchase their products if they could get it for free instead. This market "pop" came sooner than later with a recession period post 9/11, so with all of these issues not taken into serious consideration this led to financial constraints and an inability to meet profit targets. In the end overvalued and unregulated bidding wars which inevitably escalate will sap the profitability of the companies who participate - and the winner has a too high a risk of major losses. EMI also demonstrated it had issues with its artists, who were their most vital employees. EMI demonstrated that they were unable to contain its internal issues from being released to the public; most notably Carey’s intense workload and exhaustion being played off in the media. Her problems with ex-label Sony in trying to obtain the ‘Firecracker’ sample and using Ja Rule for ‘JLo: The Remixes’ also demonstrated that EMI had poor employee engagement issues (kind of vital in a people-based business) as awareness to these issues could have come to some mutual agreements with their competitor.

So it seems that whichever label took on Carey and her Glitter project would be already playing a dangerous game. Labels should have at the time (and even now) invested more in their M&A and Risk Advisory teams if they were, albeit more hesitantly, willing to make more artist signings from other labels to increase their market share. No blame should really be placed upon Carey as she was just demonstrating her value within the market and adhered to her contractual obligations. If not EMI, one of the other competing labels would have at least felt a dent in their balance sheet had this occurrence took place within their company.

TEXT REFERENCES

[A] https://www.latimes.com/archives/la-xpm-2002-jan-23-fi-emi23-story.html

[B] https://www.telegraph.co.uk/culture/music/rockandjazzmusic/3571573/A-problem-called-Mariah.html

[C] https://www.nytimes.com/2002/01/24/us/record-label-pays-dearly-to-dismiss-mariah-carey.html

[D] How the Internet Transformed the Record Business, Phil Hardy (2012)

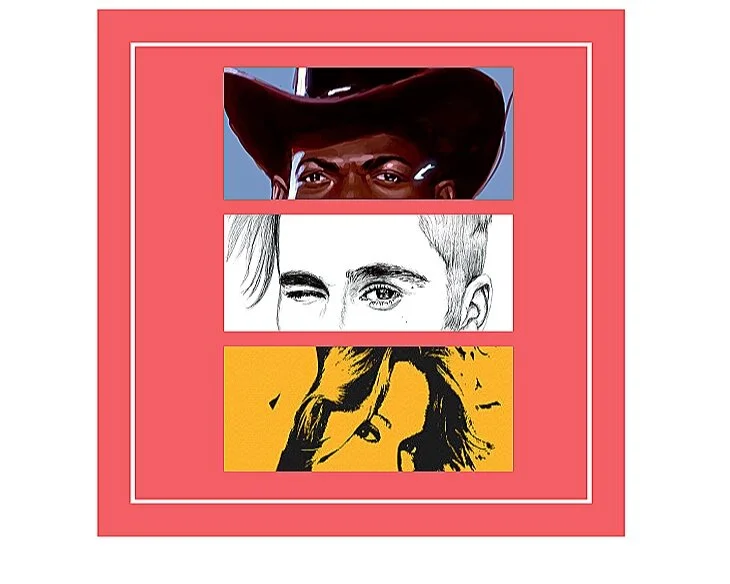

IMAGE REFERENCES (Above and in Instagram Post)

Painting by Abby McBride / https://www.allaboutbirds.org/news/wildlife-trafficking-bust-highlights-problems-in-caged-bird-trade/

Hesam Fetrati / https://www.boredpanda.com/chess-series-my-satirical-responce-to-my-society/?utm_source=google&utm_medium=organic&utm_campaign=organic

https://www.teepublic.com/en-gb/hoodie/4810759-mariah-carey-in-glitter

http://www.rmmagazine.com/2020/03/02/the-evolution-of-the-risk-manager/

PLEASE VISIT MTRUJILIO’S ART FOR MORE EXCELLENT ARTISTIC DRAWINGS